The right mindset and tools can be the compass guiding you toward an effective and profitable pricing strategy.

Ignition: Mastering your pricing strategy for tax season

As the annual whirlwind known as tax season fast approaches, accounting and tax professionals are once again gearing up for the frenzy.

But surviving tax season, or ‘busy season,’ as we’ve come to call it, isn’t just about dotting your Is and crossing your Ts. It’s about recognizing your value in a competitive landscape and making sure your compensation adequately mirrors your expertise.

This isn't a journey you need to navigate alone.

The right mindset and tools can be the compass guiding you toward an effective and profitable pricing strategy.

Using its capabilities as an all-in-one proposal, client agreement, billing, payment, and workflow automation platform, Ignition offers crucial insights so you’re not flying blind this busy season. Analyzed customer data pinpoints tax pricing trends in the United States, arming you with information to guide and inform your pricing strategy.

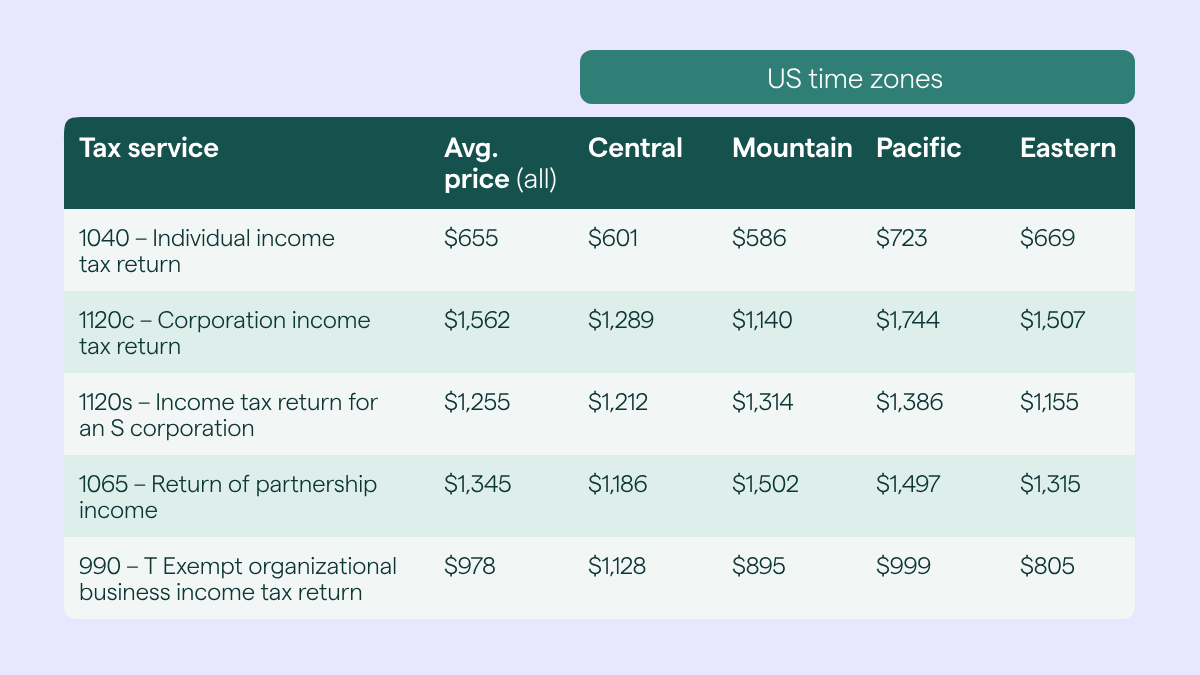

The data focuses on US accounting, bookkeeping and tax professionals using Ignition whose firms earn over $150,000 in revenue, and breaks down the average prices for key tax services provided in 2023 to date, across the four major US time zones.

The table provides you with some important insights and takeaways for pricing your own services.

One thing is clear: pricing isn’t a one-size-fits-all game. Prices vary across time zones, so it pays to recognize the unique demands of your area when setting your pricing strategy.

There are other factors to consider as well, says Tiffany W. Davis, President of Washington Accounting Services Inc., and an Ignition customer. “I also feel as if the knowledge, the education, and the training of the practitioner are important as well to how they are priced… adding that into the numbers as well as experience and qualifications to be able to justify pricing,” she says.

“You don't want to put [benchmark pricing] out there to say, ‘Hey, you should be charging someone $1,500,’ and they’ve just started, and they don't have the experience and the accolades behind them.”

Still, says Steven Byler, CXO and Co-Founder of GrowthLab Financial Services, the data is a solid reference point for firms that need a boost of confidence to expand their pricing strategies.

“Any time you can aggregate data and say, ‘Here are some actual numbers from people who are actually pricing and selling these services,’ it’s good. These are your peers.”

Tiffany W. Davis agrees. “I think it's always good to have that information available, because not everybody’s as progressive as we may be, and it may give them some confidence to be able to say, ‘Hey, I'm below the average. Maybe I need to think about not necessarily going up to that [benchmark price], but maybe I need to do something’.”

The complexity of a client's requirements can also play a role in pricing. Consider, for example, the client’s entity structure, whether they have K-1 distributions, and if they own rental properties.

"Complexity doesn’t increase my price, at least not directly,” says Jeremy Wells, Owner of JWellsCFO.

“Complexity can increase the value of a desired outcome I’m able to help a taxpayer achieve. Or complexity could reflect a chaotic approach to personal finance, and what the taxpayer actually needs is a strategy founded on simplification and better focus,” he says.

“I’ve seen plenty of this over the past few years with the rise (and, in some cases, fall) of side hustles, cryptocurrencies, nonfungible tokens (NFTs), real estate investing, and other financial activities,” says Jeremy Wells.

“Sometimes, you can deliver a lot more value – and therefore charge a much higher price – by simplifying a situation that has gone out of control."

So, are you factoring in such scenarios so you can set your rates to accurately reflect what your services involve?

If you use Ignition, for example, the built-in service library can save you the time and effort of doing this yourself. The service library enables Ignition customers to automatically import a selection of the most popular services in their region, with recommended pricing, for use in their proposals.

The National Association of Tax Professionals (NATP) 2023 Tax Professional Fee Study adds yet another dimension to this story. The study highlights that although many tax professionals increased their fees, a significant portion may still be undervaluing their services, perhaps out of fear of alienating clients.

Yet, looking at the NATP’s numbers and Ignition’s numbers side by side, Ignition customers are charging more. In fact, in the past year, they raised their prices by 10% on average.

This comes as no surprise to Jeremy Wells. “Ignition seems to attract more technologically progressive firm owners, who understand that pricing in the tax accounting profession generally does not reflect the immense value we can and do provide to the market,” he says.

The fact that Ignition customers are confidently charging more is not just because they’re bolder than the average tax professional.

With the Ignition platform’s capabilities for streamlining proposals, client engagements, and billing, they have the tools they need to adjust prices smoothly, and they set their fees to match the professional services they deliver.

Looking back at Ignition’s pricing data, Steven Byler concurs. “If you can show that the average Ignition user is able to charge more than the average practitioner, that's going to be a draw toward Ignition.”

Sure, making pricing adjustments is a delicate balancing act. You want to make sure you're paid what you're worth, but also keep things fair and transparent for your clients.

"Pricing is a lot more than assigning a dollar amount to a product or service,” says Jeremy Wells. “It’s the result of positioning in the marketplace, knowing your customers’ needs and wants, and how you frame your offer."

He shares his approach: “First, I don’t price services. I’ve used subscription pricing since I started my firm almost six years ago.

“Second, I don’t focus on ‘tax season’ per se; rather, I focus on an ongoing relationship that includes preparing returns, answering questions, offering advice, and clarifying positions throughout the year – not just during the three months before a filing deadline,” he says.

“The [tax] return is merely a reconciliation of the work that the taxpayer and I have done all year long. That’s what I price,” says Jeremy Wells.

Steven Byler and his team at GrowthLab use another approach: “We use Ignition to give every tax customer two fixed fee options: one for an on-time filing and one for an extension filing. We're going to charge more for the on-time filing, because those are premium weeks for my team,” he says.

“And if the customer is willing to pay the premium price, then I'm willing to put them into the premium timeframe; but if they're not willing to pay the premium, then they can go on extension and we can process their return when we have more time to deal with them and their data.”

You want to leverage available tools that embed price adjustments within engagements and renewals. Here, Ignition’s got your back. The platform’s service library, tiered-pricing option like the one GrowthLab uses, and new Price Increase feature let you adjust with confidence.

With the price increase feature, Ignition customers can automatically increase prices when renewing client agreements to boost profitability and counter rising business costs. Ignition prompts you to review your pricing and easily apply a percentage price increase when renewing or creating proposals.

After looking at client complexities and the value of each service you provide, the next step is effectively communicating your pricing increase to your clients. Properly packaging your services in a professional, well-articulated proposal can go a long way toward showcasing their value and yours.

Of course, tax season or not, who has the time to create a tailor-made proposal for every client? Again, this is where Ignition comes in.

With expertly designed, industry-vetted proposal templates specifically for tax services that include recommended pricing for the included services, the platform ensures that you always present your offerings in the most professional manner.

Ignition also saves you a considerable amount of time. Truth be told, Ignition customers save on average more than six hours a week creating proposals and issuing engagement letters.

When you don’t need a full-fledged proposal to communicate with your client, Ignition also has email templates you can use to communicate your pricing increase:

Hi [FIRST NAME]

This is to let you know that there will be an increase of [INSERT AMOUNT] in our [INSERT SERVICE LINE] pricing. This will take effect when our current engagement ends, which means that if you decide to renew our engagement, the new agreement will reflect this pricing.

We’ve made every effort to delay and minimize our price increase. But as you may know, businesses across the country are experiencing ever-increasing costs, and our accounting firm is no exception.

This change in our pricing will enable us to continue delivering high-quality services and help ensure that your business is well taken care of.

We truly appreciate your support and we look forward to continuing to work with you.

Sincerely,

[SENDER NAME]

Hi [FIRST NAME]

After carefully reviewing our costs and services (which we also encourage you to do), we have made the decision to increase our monthly engagement pricing. Beginning [INSERT DATE], your engagement will cost [INSERT AMOUNT] per month.

Please know that we have made every effort to minimize and delay this price increase. But as you know, costs have been steadily increasing since last year. This change in our pricing will help ensure that our team has all the resources needed to serve you.

We thank you for being a valued client and we hope to continue working with you in the years to come.

Best regards,

[SENDER NAME]

Hi [FIRST NAME] —

We wanted to let you know about changes to our hourly rates. Beginning [INSERT DATE], our new prices will be [INSERT AMOUNT].

Please know that we have done our very best to hold off on raising our rates. That said, businesses across the country have seen major increases in costs, and our firm is no exception.

This new hourly rate will allow us to continue delivering our services with the quality and care you’ve come to expect from us.

We appreciate your business and look forward to supporting you and [INSERT BUSINESS NAME] going forward.

Best regards,

[SENDER NAME]

Ignition proposals not only streamline your process but also enhance the client experience. For example, you can present your clients with a choice of up to three proposals, ranging from essential offerings to premium packages. This effortless process simplifies the decision-making for your clients, guiding them towards the optimal choice that aligns perfectly with their requirements.

"What Ignition makes easy is providing a professional, low-friction way to deliver proposals to customers,” says Jeremy Wells.

“With customizable email notifications, PDF brochure attachments, and embedded videos, I can create and reinforce the high-quality positioning I strive for with my firm while demonstrating a deep, personal understanding of each and every customer. So, I can create an experience that aligns with higher pricing relative to the market," he says.

It's all about presenting your value in the right light.

When it is tax season, or as your firm scales to take on bigger projects, you may be inclined to send out a deluge of proposals. With its bulk proposal feature, Ignition can also help you strike that delicate balance between quality and quantity by speeding up the process without losing that personal touch.

Keep in mind, too, that the end of a client agreement does not – and should not – mean the end of a relationship. In the midst of the hustle and bustle of tax season, it can be easy to let opportunities to renew client engagements slip through the cracks.

With Ignition, you can stay proactive with automated reminders and other effective client management tools to make sure you are continuously nurturing your client relationships.

The other advantage of using Ignition for your tax clients is automating client billing, client payments and getting paid upfront. This is a big but beneficial change for firms that are used to waiting for their clients to pay them after they do the work. (By the way, if customers push back on inputting their payment information upfront, just imagine how hard it will be to get them to pay once you’ve done the work.)

It’s a massive shift in the relationship – rather than doing the work and then having to act as debt collector, chasing your clients for payment, you are billing appropriately for the full service you provide.

This, in turn, changes how you communicate with clients once their tax prep is complete.

It changes the conversation from ‘I’m done; you owe me’ to ‘I've finished your return, and we're all set. Let’s talk about the other services we provide.’ That’s a much better position to be in.

What’s more, it again saves you time. Ignition customers report saving an average of more than nine hours a week billing, invoicing, collecting, and reconciling payments.

It’s true, raising your pricing game – and your prices – isn't just about figures in a spreadsheet. It's about understanding and earning compensation for the deeper value and efficiency you bring to the table. To sum up, here's how you can power up your approach:

Value your time. It's a finite resource. Free up hours from tedious and manual tasks, and think about where you can better spend that time. Maybe it's advanced training, branching into advisory services, or strengthening client relationships. These are avenues to back up a premium pricing model.

Streamline your operations. Efficiency isn't just about speed, it's also about quality. There are tangible benefits to optimizing your processes, such as improved cash flow, faster turnaround times, and better client experiences.

Stay adaptive with your pricing. Business costs aren't static, nor should your prices be. Constantly keep an eye on them, and make sure they reflect the reality of the market and your costs. David Thomson, Partner at Certus Group Accountants, says it in a nutshell: “Price reviews routinely get forgotten. So it’s brilliant that Ignition will prompt me to put up our fees in line with our new pricing policy. No more leaving money on the table!”

Conquering tax season is all about seizing the opportunities that come with it. With every challenge tax season throws at you, there's a chance to up your game.

With Ignition, you can feel confident that you've got the right tools at your fingertips. From expert-crafted proposal templates for forms like 1120C, 1120S, 1065, and 1040, to optimized service pricing and terms. We make sure you're set up for success, both in value and efficiency.

Want to find out more? Watch an on-the-spot demo. Then create an account with Ignition today to unlock access to templates, including service pricing and terms.

Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.