Businesses not registered for GST but charging GST are more common than you think.

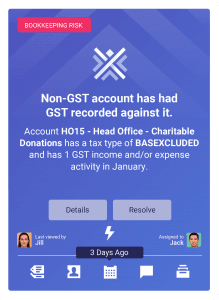

Businesses not registered for GST but charging GST are more common than you think. Ensuring GST is claimed correctly, is important not just for your Business Activity Statement (BAS) reporting, but your cashflow. When GST details are incorrect, you may pay GST you don't need to, or you may receive credit for GST paid that you are not entitled to. This can be disastrous for any business’ cashflow. A scary 59.6% of accounting files analysed by XBert last quarter has ABN or GST errors. Keeping across every supplier or contractor details, changes in ABN and GST status – it's tough. Especially as your business grows and you’re focused on what you do best – running the business. GST issues that can affect your cashflow can be spotted as they arise when you have XBert AI Audit as your second pair of eyes. Business charging for GSY when not registered for GST, is just the beginning.

Let's say Zoe changes the default tax setting for the inbuilt Sales account from GST on Income, to BAS Excluded. John's used this Sales account many times before and creates a new invoice with several line items against this account. He doesn't realise that now GST won't be added to the invoice. The customer receives the invoice without GST, but the business should be charging GST.Or, what if John creates an account to capture a new revenue line called 'Other Sales by Zoe'. The default tax setting for this new account is BAS Excluded. John tells Zoe to use this account on invoices she creates. Some of the invoice line items legally must have GST on them, but invoices go to customers, and GST is not collected.In both the above examples, if the tax office were to audit the business, they may demand the missing GST be paid. If the business hasn't already collected the GST amount, it may be difficult to now ask customers to pay as time has passed and it's not their mistake. The business may have to pay the amount themselves.

Imagine Steve owns a printing business and attaches a file (a scan of a tax invoice) to a bill created in Xero. The bill is for catering supplied by Bob's Burgers and claims GST. However, the attached tax invoice from Bob's burgers has no GST number.This account may be set up incorrectly. Or, it may be set up correctly, but does not included a valid attachment with a valid GST number - either way, you will know and be able to check it out, before it hurts your bottom line.

It's best practice and smart business to ensure your bookkeeping and payment records are accurate and up-to-date. Good record-keeping means you can claim the right tax deductions and have a reliable picture of business health and trusted insights. This means you can make the right decisions for your business.XBert's AI Audit analyses your Xero, MYOB and QuickBooks data multiple times a day, scanning attachments and monitoring the Australian Business Register to protect you and your business. You can stay on top of your books, financial risks and compliance all year.To find out what errors (if any) are lurking in your books at the moment - load your file into XBert for a free, 30 day trial. In minutes you'll see whether you've been missing any important changes to your suppliers contact details, ABN and GST errors and so much more.

Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.