Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.

Keeping track of as many financial health indicators of both your business and companies you work with is key to staying ahead of any surprises.

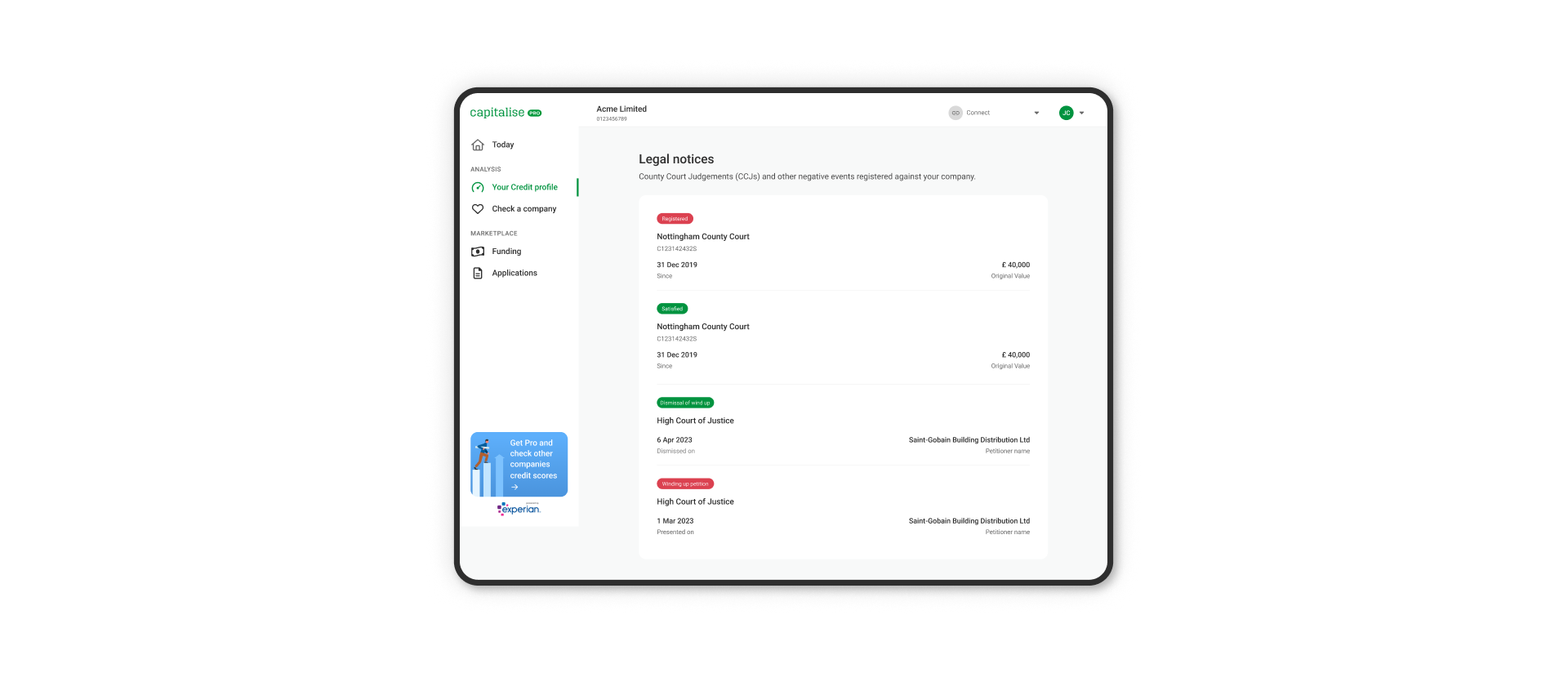

Capitalise have been busy adding more data to the platform to make sure you’ve got as much information as possible, including expanding out our Legal Notices section.

Winding Up Petitions and Dismissals now join CCJs in our latest product update.

Our legal notices now include two new types of notice if they are registered on your credit profile, or any companies you’re managing.

Legal notices are typically ways for creditors (people who owe a company money) to try to recover their debt with the company.

These are three different types of legal notices we show on Capitalise:

CCJs

Winding Up Petitions

Dismissals

A winding-up petition is a legal action taken by a creditor against a company that owes them money. The petition is a formal request to the court to initiate the process of winding up or liquidating the company due to its inability to pay its debts.

This will ultimately lead to the closure of the company, as well as its assets being used to pay off creditors.

Winding-up petitions and orders become a matter of public record and are listed in the Companies Court Winding Up List. This information is accessible to the public and may have implications for the company’s reputation.

To reduce the likelihood of your company getting a Winding Up Petition, you should:

Ensure to maintain healthy relationships with partners by having open and honest conversations.

Avoid negative impacts to your company credit score by settling outstanding debt in a timely and consistent manner.

Eradicate filed winding-up petitions to protect your company’s reputation

You should also be monitoring the companies that you work with to ensure they do not have a Winding Up Petition. Doing so will help to ensure that:

You work with the right companies

You protect your cash flow from threats of non-payment from companies experiencing financial distress

You avoid nasty surprises by tracking your partners

A dismissal occurs if a company settles the outstanding debt from a winding up petition. The winding-up petition to force the company into insolvency is then removed.

While a dismissal will show that a business has settled the debt, you should still treat this as a red flag for late payment from new or existing customers and/or debtors.

A CCJ is an order issued by county courts to settle a debt a business has failed to pay. A business will get a CCJ in the event that they do not pay, their creditor takes the matter to court and the court agrees with the creditor.

If a CCJ is not settled within 30 days, it will be registered against a business’ credit profile for 6 years. This means it can have a long lasting effect on a business’ credit score, so its important to act quickly if you have a CCJ registered against your company.

Read here for insight into what you should do if your business has a CCJ.

If a company you work with has a CCJ registered, its important that you quickly take steps such as chasing any outstanding invoices and not extending further credit to protect your business’ cash flow.

Whenever our platform detects a legal notice, including CCJs, Winding Up Petitions or Dismissals, we will include this in our weekly summary from Capitalise.

Check your Today page for any new legal notices or insights for your business and the companies you’re tracking.

Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.