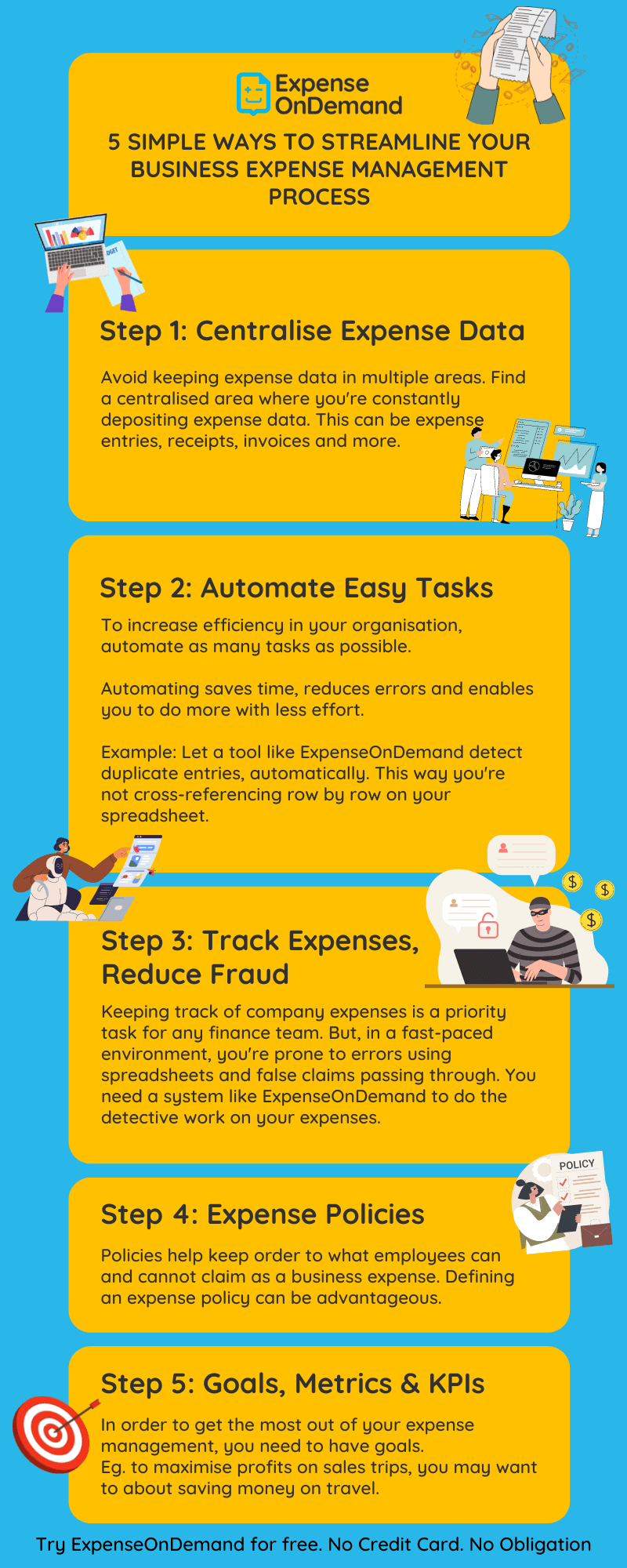

In this article, ExpenseOnDemand cover the 5 simple steps to streamline your business expense management process.

Let us agree on one thing - business expense management is a tedious process.

Can you imagine being in 2023 with desk draws full of paper receipts, printed invoices and awkwardly formularised Excel spreadsheet?

If you don't have the right controls in place, expense management can be a time-consuming and complex process, especially if you have a lot of expenses to track, monitor, and reconcile.

But it needs to be done. Are there better ways to unite the team to make the whole process easier, faster and more successful for the company? Absolutely.

In this brilliant article, we'll cover the 5 simple steps to streamline your business expense management process.

Before our clients joined ExpenseOnDemand, they would tell us expense management seemed easy and that they had a system that worked for them.

They used Microsoft Excel and ledgers to manage their expenses and relied on algorithms and formulas to pick up on certain things. Human error can be costly - especially when you’re operating at scale too.

Luckily, this post will show you how to overcome this, don’t panic!

After streamlining expenses, it’s much simpler now using automated expense solutions. The best part is that all their teams are on board with submitting expenses as they happen. This means that finance teams no longer have to chase paper; instead, they focus on company growth.

Streamlining your processes is ideal if your expenses are out of control or you're looking for ways to improve your business efficiency.

Let's get into it.

1. Map Your Expense Data Into A Centralised Area

The number 1 rule to succeed at anything, let alone expense management, is to get organised. 91% of people say a better-organised workspace would make them more effective and efficient.

You'll be able to understand your company's finances better if you centralise all expenses in a single system and everyone contributes to it. - Take a look at ExpenseOnDemand and try it for free today.

You can also track your company's financial performance and identify cost-saving opportunities.

Pro Tip: Sticking to one system for all your expense data is essential. Naturally, keeping some data in a tool, a spreadsheet, and some on your mobile phone disconnects your reporting, meaning that you'll see inaccuracies in your financial information.

It kind of defeats the point right?

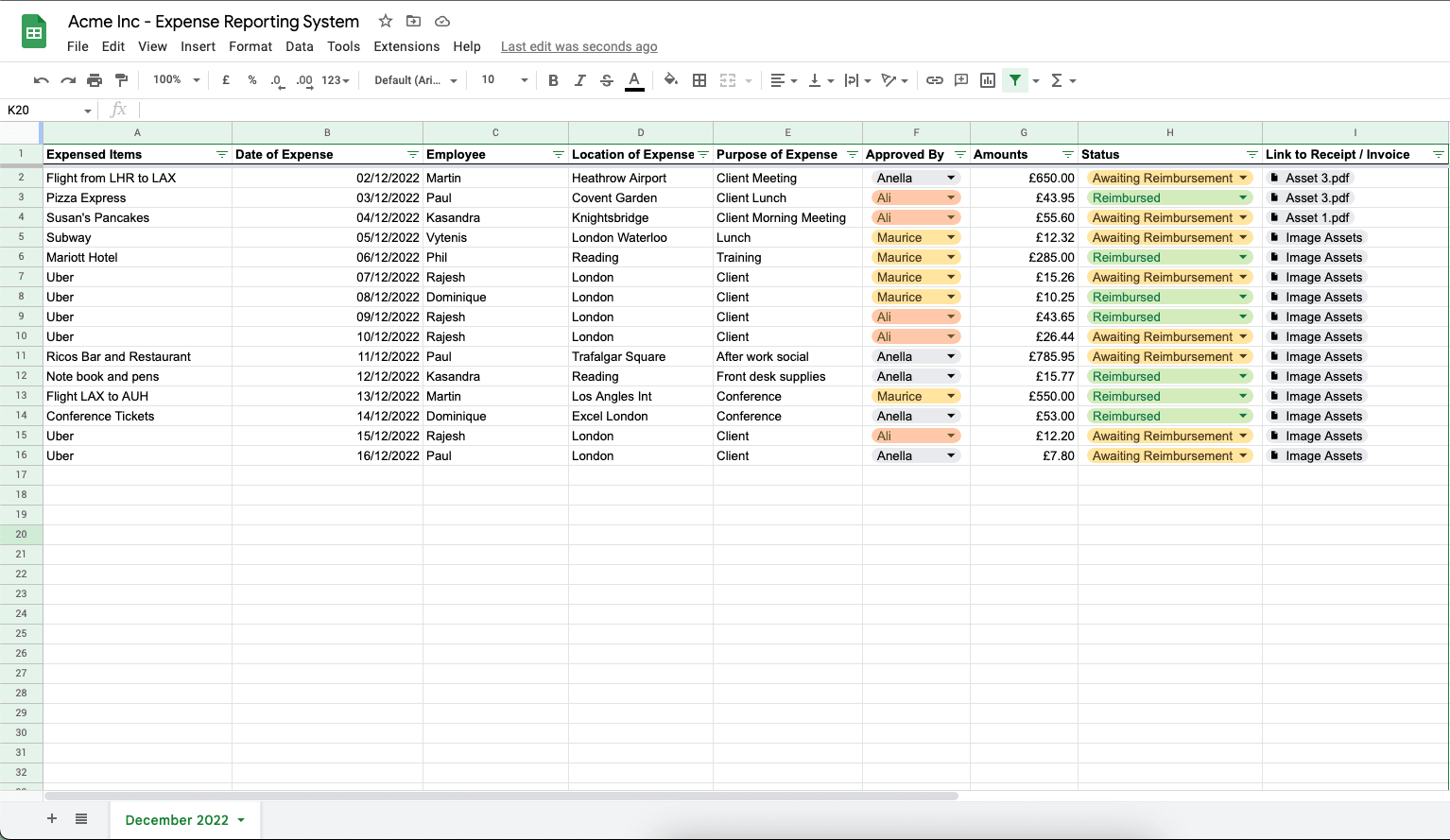

If you're considering creating an expense system from scratch on your own, there are some things worth including in order to have a good expense report. Start off by documenting:

1. Date/time stamp

2. Business purpose, essentially the reasoning behind the expense ie: client meeting

3. Location of where the expense was made in terms of area.

In the end, your expense system could look something like this:

Example of a typical expense management process using Microsoft Excel

2. Automate Manual and Tedious Tasks

Whenever possible, automate as many tasks as possible to boost efficiency.

In other words, would it be helpful if all the small tasks and trivial bits were automatically taken care of so you and your team could focus on the growth aspects of the business?

Expense automation can help reduce errors, save time, and enable you to do more with less effort.

For example, an expense automation system can automatically capture, approve, and pay employee expenses. This is done from when a receipt is uploaded to when money is transferred to the employee's account.

Each member of your team is assigned access whether they’re using our mobile app or the online cloud portal, making and managing expense claims has never been easier.

This video demonstrates how ExpenseOnDemand automates manual expense tasks and can save time and money. No more manually entering data into spreadsheets or tracking down receipts – now everything can be done in a few taps.

3. Track Expenses and Reduce Expense Fraud

A question for you...

When it comes to expense management, where do you spend most of your time getting confused?

To give you some ideas after talking to our clients and why they decided to join ExpenseOnDemand, they were having trouble with:

• Managing and reducing errors

• Tracking where expenses were made

• Genuineness of an expense

• Filter out duplicate expenses

• Company budget monitoring

• Spending more time on things that contribute to company growth

and more.

If you think about this for your own business, it can be frustrating and a bit overwhelming. That's why we're here to help. One of our helpful guides can help you get better and more accurate expense reporting and processing by advising and guiding you on the right path. Speak to a pro.

Keeping track of your expenses is just as key as reducing errors to make sure you know what you're making and what you're losing. In addition, tracking expenses helps you determine where money is being spent unnecessarily and then adjust accordingly. If left unchecked, overspending can lead to a huge loss of profits.

For instance, tracking expenses can help you identify small items such as office supplies that add up to a large sum over time, and then adjust those purchases to reduce costs.

When it comes to expense management, the best way to streamline tracking expenses and reduce errors is to use a system that is designed to detect and report just these kinds of things.

If you're just starting out, spreadsheets might be a great choice, but you'll find that you'll end up putting in more effort managing PDF invoices, scanning receipts, and logging them into spreadsheets. In the past, that all made sense. But today, there are better ways to work with employees and get "more bang for your buck".

Human beings can accomplish extraordinary things when given room to think and plan. It would be a shame to see the potential of your team being used to do mind-numbing tasks that can be taken care of in minutes using sophisticated tools

4. Get Your Team Onboard with Expense Policies and Procedures

Ensuring there are clearly defined policies and procedures is an effective way to streamline the process. These should be reviewed regularly and updated as needed. But don't forget to have a little fun along the way. After all, work should be enjoyable, not just a grind!

Having an expense policy and procedures ensures that everyone in the organisation knows the types of claims they can and cannot make.

For instance, a policy may state that employees are reimbursed for travel expenses up to a certain amount, with any additional costs being the employee's responsibility.

It's critical to update your expense policies to ensure your business is covered daily. Things change constantly, so there's no one "write it once, and you're set for life" type of policy. The demands of your company will change as your business evolves, so make sure your policies are up to date every year.

We have a complete guide on everything you need to know about company expense policies, and by the end of it, you can expect a fully-fledged policy to take into the office on Monday morning. Complete Expense Policy Guide - Read More.

5. Goals, Controls, Metrics and KPIs

You need to set up proper controls and metrics. But before you can do that, you need to define the problem. What are your goals with your expense management system?

Take a moment to jot these down. Below is an example to warm up your thinking.

For example, if you're trying to cut costs by 10% across all departments, or you want to maximise profit margins on sales trips or client meetings, you might want to think about how to save money on travel expenses.

It keeps your team focused so they don't get sidetracked by things like "what other people think" or "how difficult it might be."

Defining a goal and communicating it to your team (for example, in newsletters) is the most effective way to make sure everyone knows what it is! You don't want anyone to lose sight of the reason they're streamlining their business expenses.

Efficiency, improved compliance, and lower costs can all be achieved by streamlining business expense management.

You'll be able to control your business expenses if all expenses are recorded accurately and on time.

Expense management made easy - Employees can view all their expenses in one place, so they can work smarter instead of harder!

A better handle on business expenses - If an employee knows exactly where their money is going, they're better off making better decisions about what to cut out or what they'll do differently next time around, instead of just blindly accepting whatever comes up next month without asking why it's necessary now (or then).

Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.