Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.

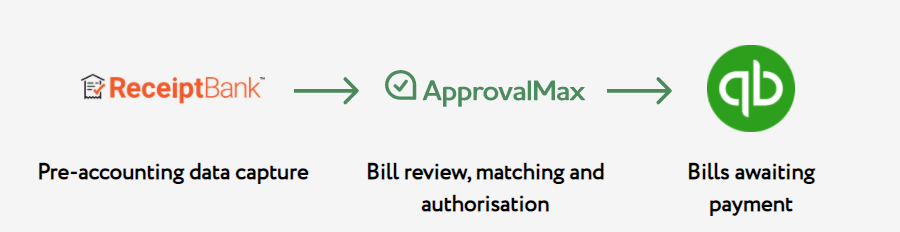

ApprovalMax have released a direct integration to Receipt Bank, with approval workflow benefits for both QuickBooks and Xero customers.

ApprovalMax have released a direct integration to Receipt Bank.

The benefits of the integration are relatively minor for Xero customers, however the integration does open up possibilities for bill approval workflows for QuickBooks Online customers.

Receipt Bank needs to be configured to send all digitally captured invoices to ApprovalMax instead of QuickBooks Online.

Pre-accounting data capture

After extracting the relevant invoice data, Receipt Bank enters the information into the bill fields and attaches an invoice scan to the digital invoice copy before pushing it to ApprovalMax for authorisation.

Bill review and authorisation

In ApprovalMax, each invoice is routed to the appropriate manager with the specified authorisation level as determined in the approval matrix.

Bills awaiting payment

Once approved via the web or mobile ApprovalMax app, bills are published to QuickBooks Online. A notification about the successful authorisation is sent to the specified address. A detailed audit report containing the approvers’ names and approval dates is created automatically and attached to each approved document. Such automatic audit trail can be accessed directly from QuickBooks Online.

This direct integration allows Receipt Bank to push finance documents like supplier invoices and expenses directly to ApprovalMax for proper authorisation instead of sending them to Xero as drafts.

Keeping the general ledger orderly

No unauthorised bills enter in the accounting system as only fully authorised bills with the “Awaiting Payment” status and are published to Xero. In comparison the previous workflow with Receipt Bank pushing drafts to Xero before being picked up by ApprovalMax meant that unapproved bills would enter Xero, with a risk of them being inadvertently approved and paid before authorisation.

Minimising the risk of fraud and human error

Approving bills in Xero incorrectly is impossible because bills are only published to Xero once they’ve been authorised in strict accordance with the approval matrix set up in ApprovalMax.

Specialised workflow for new suppliers (coming soon)

Bills from new suppliers will be identified as such and trigger alerts to the administrators or marking with a flag to raise awareness.

Automating the approval of paid bills

No more tracking paid bills in Xero to manually route them for approval. Bank transaction data of their payment is retained and pushed to Xero along with the approved bill.

Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.