Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.

Predict now automates the calculations needed to ensure accurate VAT/GST predictions if you are on the Cash scheme

An update brought to you by Futrli Predict

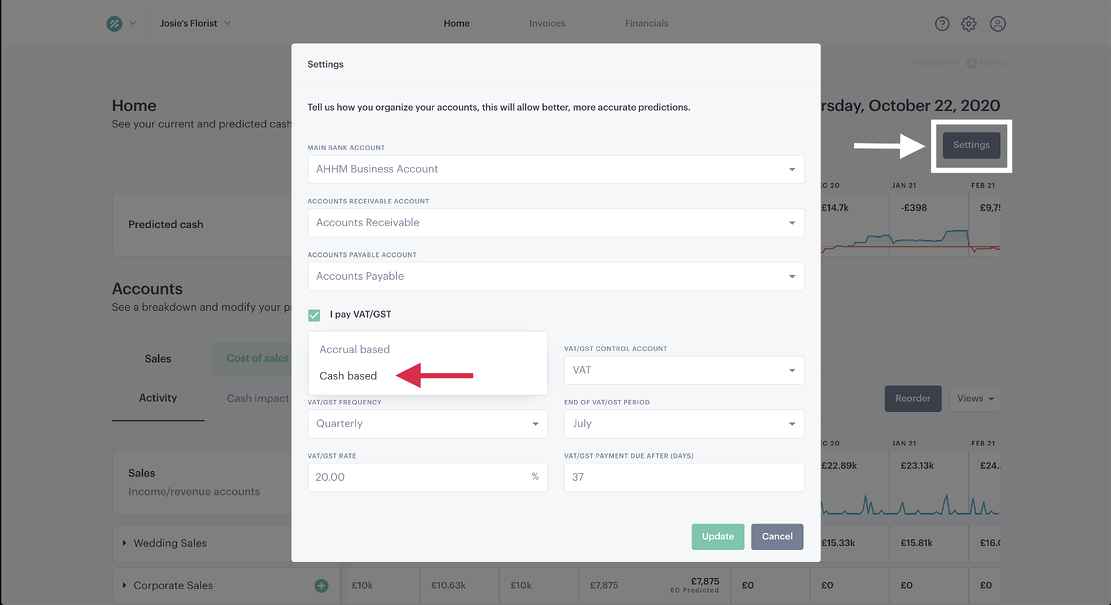

Many of our users have asked us to extend the Predict VAT / GST calculation schemes to include Cash based as well as Accruals based.

It’s now live.

Paying VAT or GST on a cash basis is common, and manually calculating tax payments is really difficult – given the variability in invoices or bills being paid.

Put simply with the Cash Accounting Scheme you:

Pay tax on your sales when your customers pay you

Reclaim tax on your purchases when you have paid your supplier

Predict will pay tax on sales when they are predicted to be paid

Predict will reclaim tax on your purchases when they are predicted to be paid

Predicted VAT/ GST liabilities are the most accurately calculated predictions, globally today.

You (or your clients) are never caught out.

Check it all out in their public product roadmap now!

Want to find out more about Futrli? View their directory listing on our site here.

Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.